Mandatory market-wide accounting adjustments due to inflation appear to be delaying Turkish public companies’ 2024 annual general meetings, and may push proxy season back several months. However, financial institutions are controversially excluded from the accounting requirement – placing the institutions in a position of paying tax on inflationary asset revaluations and placing the burden on investors to reconcile between real and nominal profits driven by inflation.

Key Details

Following Türkiye’s high inflationary environment in recent years, conditions for inflation accounting were met as of fiscal year 2022 – however, the implementation of inflation accounting was postponed until fiscal year 2023. As a result, most Turkish public companies that keep their records in the local currency will be obliged to apply inflation adjustments to the non-monetary assets in their balance sheets for their FY2023 financial statements. The revaluation gains that are attributed to inflation are excluded from the income statement and recognized directly in equity so that profits are not impacted.

Notably, financial institutions are excluded this year, with implementation delayed until 2024. Until then, investors and other stakeholders will need to closely scrutinize banks’ financial statements due to the potential for misleading historical comparisons and inflationary asset value gains being included in the profit/loss. Banks have asked to apply inflation accounting, complaining that the exclusion will force them to pay higher taxes based on nominal profits – without accounting for inflation, sector-wide profits increased by over 300% for 2022, and over 50% for 2023.

What Inflation Accounting Means for Companies: IAS 29

Under inflation accounting, companies are obliged to employ Turkish Accounting Standard 29 “Financial Reporting in Hyperinflationary Economies”, which requires the financial statements to consistently reflect the local currency value at the balance sheet date, in line with International Accounting Standard 29. The goal is to ensure financial information is meaningful, protecting investors and all stakeholders from the misleading implications of nominally high profits and allowing a more meaningful evaluation of financial ratios. This approach is particularly beneficial for companies that operate with high inventories and/or have large fixed assets.

Delayed Reporting & Shareholder Meetings

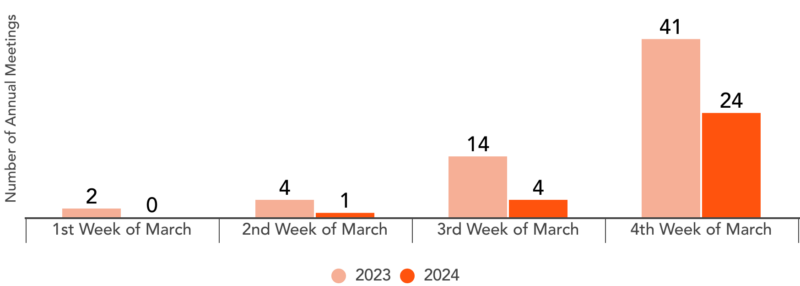

Given the additional work involved in adjusting historical figures for comparative purposes, companies will have a ten-week grace period to submit their inflation-adjusted FY2023 annual financial statements, pushing submission deadlines into May for some companies. This could in turn delay the upcoming proxy season, with annual general meetings typically held in March, April, and May potentially delayed several months. To date, we have observed a roughly 50% decrease in the number of annual meetings held between February 1 – March 31 compared to 2023.

How Long Does Inflation Accounting Apply?

Under the Tax Procedure Law of Türkiye, if the producer price index increases by >10% in the current year, and >100% over the past three years, inflation accounting adjustments become mandatory for companies who use the balance sheet method to determine earnings. It ceases to be in effect when one of the conditions becomes obsolete. Based on government forecasts from September 2023, that could happen by 2026; however, inflation increased sharply in February, exceeding analyst expectations. Most recently, on March 21 the Turkish Central Bank raised the policy rate (the one-week repo auction rate) from 45 percent to 50 percent.

Regardless of how long inflation accounting is in effect, the impact on proxy season should be limited to 2024. While the need to adjust financials is likely to remain a factor over the coming months, as companies become familiar with inflation accounting there should be no need for further reporting delays.

Philip Foo contributed to this report.