Through our strategic partnership, all market participants have access to a combined suite of products that offer expanded visibility into the data, peers, and benchmarking used by Glass Lewis’ global research team. From unique compensation analytics and peer comparison tools, to board effectiveness insights, companies and investors have access to the most comprehensive source of governance information at their fingertips.

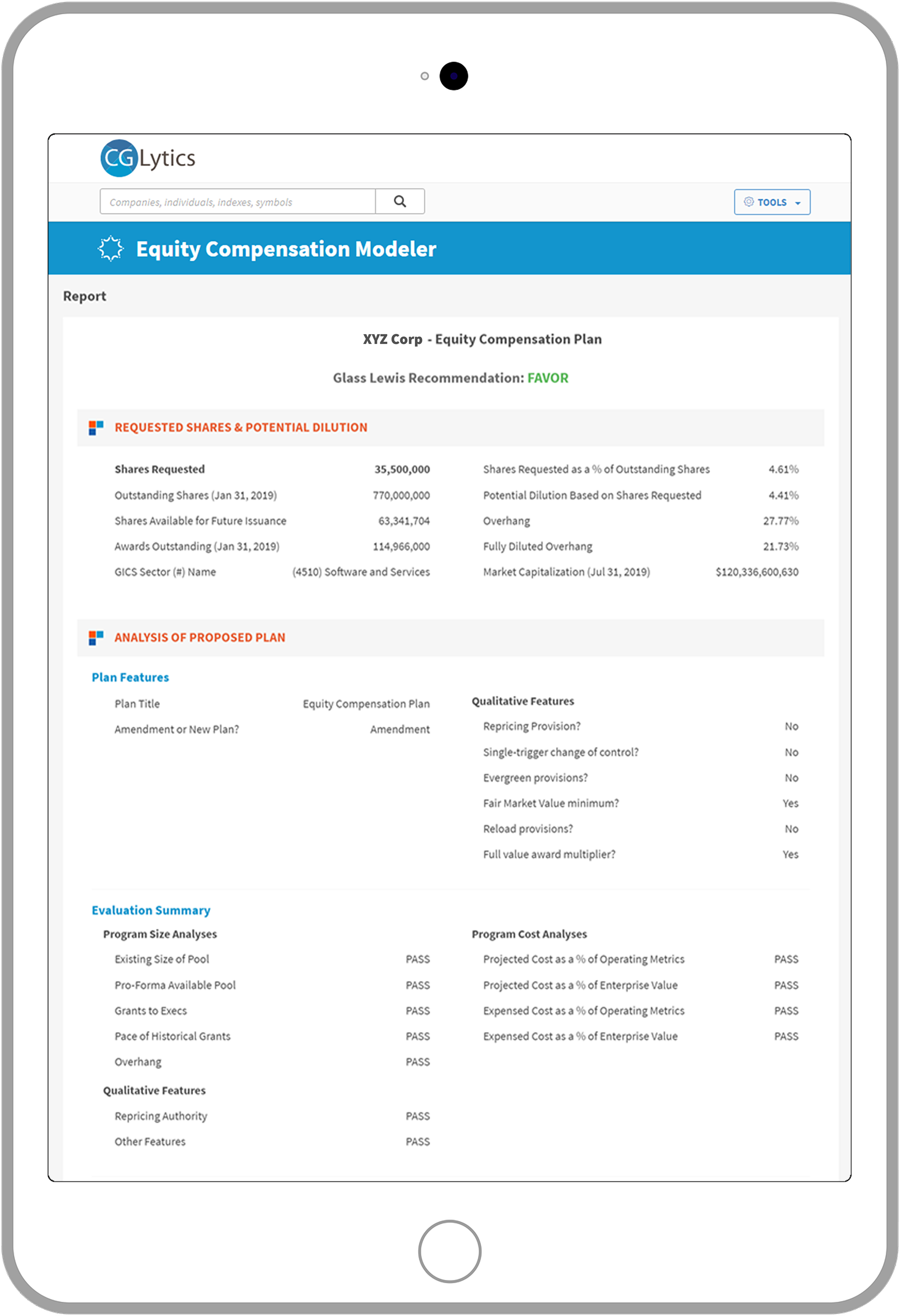

Equity Compensation Model (ECM) – Year-round, on-demand access to the models used by Glass Lewis’ research team to assess equity compensation plans, including tests against 11 key criteria, is available via Diligent Compensation & Governance Intel’s proprietary platform.

Companies, investors, advisors and board members can now instantly test, review and adjust individual inputs using the same tools as Glass Lewis’ analysts to ensure the best compensation, engagement and voting outcomes for their respective sides. Access to the ECM provides companies with immediate and proactive insight into the concerns regarding current and future equity plans, which Glass Lewis highlights to more than 1,300 investors representing more than $40 trillion in assets under management. In addition, with coverage of more than 4,300 publicly traded US companies, investors can assess plans across their portfolio, perform comprehensive benchmarking of costs and evaluate the risk of any potential dilution to enhance their engagement and voting decisions.

Companies, investors, advisors and board members can now instantly test, review and adjust individual inputs using the same tools as Glass Lewis’ analysts to ensure the best compensation, engagement and voting outcomes for their respective sides. Access to the ECM provides companies with immediate and proactive insight into the concerns regarding current and future equity plans, which Glass Lewis highlights to more than 1,300 investors representing more than $40 trillion in assets under management. In addition, with coverage of more than 4,300 publicly traded US companies, investors can assess plans across their portfolio, perform comprehensive benchmarking of costs and evaluate the risk of any potential dilution to enhance their engagement and voting decisions.

The ECM is available as a stand-alone service and is only available via Diligent Intel and its market-leading software. The offering, initially launched for the US market, covers 4,300+ publicly traded U.S. firms including the Russell 3000, S&P 1500, S&P MidCap 400 and SmallCap 600.

Learn More:

White Paper

Use Case: Shutterfly

Press Release

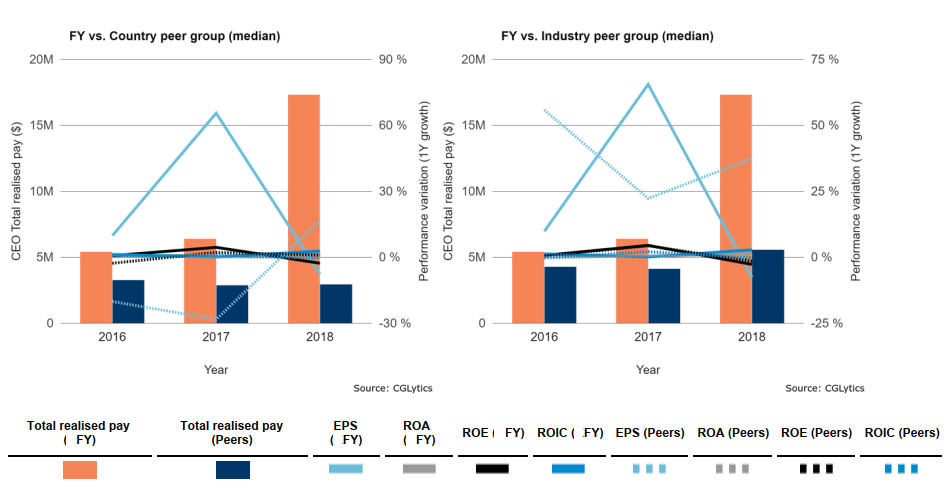

Say on Pay Models and Peers – Glass Lewis leverages Diligent Compensation & Governance Intel’s data and powerful compensation modeling software to generate the “Remuneration/Compensation Details” featured in Say on Pay analysis and Proxy Paper research reports across thousands of companies globally.

The proprietary peer methodology underpinning the analysis considers both country-based and sector-based peers, along with each company’s disclosed peers. The charts and graphs displayed provide concise and valuable insights, examining a company’s relative alignment between CEO pay and a variety of key performance metrics relating to earnings and returns.

The enhanced compensation models, data and peer groups used by Glass Lewis’ research team are available via Diligent Compensation & Governance Intel’s proprietary platform, giving investors, issuers, advisors and board members exactly the same tools to scrutinize and model CEO and executive compensation plans, and prepare for engagements with all stakeholders.

Learn More:

Use Case: Capri Holdings

Use Case: Persimmon plc

Use Case: Deutsche Bank

Press Release

Custom Policy – Investor clients using the Viewpoint proxy vote management service can integrate Glass Lewis’ proprietary data into their custom proxy voting policies. This provides a broad and deep set of options for clients to consider when designing their tailored approach to voting on directors and proposals relating to compensation matters.

Visit our Say on Pay Analysis page for more information.